Warwick Acoustics secures major automotive contract

Mercia announces that Warwick Acoustics Limited secured its first production contract with a leading global luxury vehicle manufacturer. The multi-year contract is with a global top 10 luxury manufacturer and is a major milestone for Warwick Acoustics, validating the performance and scalability for its proprietary automotive audio system, which is based on electrostatic transducers. The contract will initially be for two vehicle programs and will be delivered via a significant expansion of Warwick Acoustics’ design, development and manufacturing capabilities.

Mercia exits Intechnica in £14.5m sale to US company

Mercia is pleased to announce the profitable sale of Intechnica Holdings Limited for a total enterprise value of £14.5million, to US-based Crosslake Technologies LLC. Mercia held a 25.5% direct holding in Intechnica at the date of completion and will receive cash proceeds of £3.7million, generating an internal rate of return (“IRR”) of 27% and a 1.7x multiple on its current holding value.

nDreams continues its progress with first acquisition

Mercia announces that nDreams Limited has acquired Brighton-based Near Light Limited. Founded in 2016, Near Light is a long-term partner of nDreams and a virtual reality and augmented reality game development studio. Near Light developed the nDreams-published Perfect and Shooty Fruity VR titles, in addition to recently pioneering an AR experience for one of the world’s leading toy brands.

Acquisition of Frontier Development Capital Limited

Mercia is delighted to announce that it has acquired the entire issued share capital of the central-Birmingham headquartered Frontier Development Capital Limited, for a total consideration of up to £9.5million plus net cash. FDC is a leading, regionally focused lender to SMEs, with c.£415million of funds under management. The acquisition is expected to be immediately earnings enhancing. FDC has successfully built loan portfolios totaling c.100 companies, predominantly located across the Midlands and the North of England. As well as its Birmingham head office, FDC also has offices in Manchester and Bristol, two of Mercia’s existing office locations

Mercia completes sale of Faradion £100.0million to Reliance New Energy Solar

Mercia is pleased to confirm completion of the sale of Faradion for a total enterprise value of £100.0million to Reliance New Energy Solar, a wholly owned subsidiary of India-based Reliance Industries, the multinational conglomerate. Based in Sheffield, Faradion is a world leader in sodium-ion battery technology that provides low-cost, high-performance and sustainable energy storage solutions. Mercia held a 16.4% fully diluted direct holding in Faradion and has received initial unrestricted cash proceeds of £18.6million, plus a further £0.8million ring-fenced for three months. Mercia made its first direct investment in Faradion in January 2017 and Mercia’s managed funds have held equity stakes in Faradion since its inception..Read more

Sale of OXGENE delivers strategic objective of ‘evergreening’ Mercia’s balance sheet

Mercia’s sale of OXGENE is a great example of how Mercia’s EIS funds and its balance sheet proprietary capital work together to provide superior returns. The exit, which was announced in March 2021, reaffirms the significant opportunity and value creation potential offered by Mercia’s ‘funds first’ hybrid investment model, which is focused on promising regional companies. We refer to this as ‘the thriving regions’ and it follows the same format as our exit from The Native Antigen Company. Mercia held a 32.1% direct holding in the business prior to completion, receiving cash proceeds of £30.7million, our largest cash exit to date.

Mercia-backed It’s All Good acquired by Irish Valeo Foods Group

Gateshead-based It’s All Good, which makes pitta chips and tortilla snacks including the Manomasa range, was acquired by the Irish Valeo Foods Group in December 2020. Mercia’s Northern VCTs first invested in the savoury snack manufacturer in February 2014, backing former Union Snacks MD Calum Ryder who set up the company with Michael Weatherhead and Lynn Saul. It’s All Good was one of four North East firms which this year made the Alantra Food & Beverage Fast 50 and was ranked one of the UK’s fastest-growing privately-owned food and drinks businesses.

Mercia achieves a 1.8x return on exit of Refract

Refract provides sales engagement and conversation analytics that help sales teams improve conversations and close more deals. It uncovers decisive moments in sales conversations for coaching and insight. Key moments can be highlighted with effective feedback, sharing playbook moments and using AI to expose what leads to successful outcomes and top performers in an organisation. Mercia first backed the company in 2016 and made a follow-on investment in 2017. Mercia achieved a 1.8x return on its original investment, equal to a 20% IRR.

Mercia completes successful exit of Agilitas

In November 2020, Mercia completed a successful exit of channel service provider, Agilitas IT. The business, which delivers managed inventory solutions and technical, lifestyle and training services, initially found support from Mercia’s Northern VCTs in 2014 with an investment of £6.4million . The transaction is part of a management buyout, with Mercia continuing to back the company with ambitious international growth plans. Agilitas delivered year-on-year double-digit growth over the Northern VCTs’ tenure through continued innovation and expansion of its channel service propositions and geographic footprint. It was sold to the international private equity investor Perwyn, providing an 8.4x return.

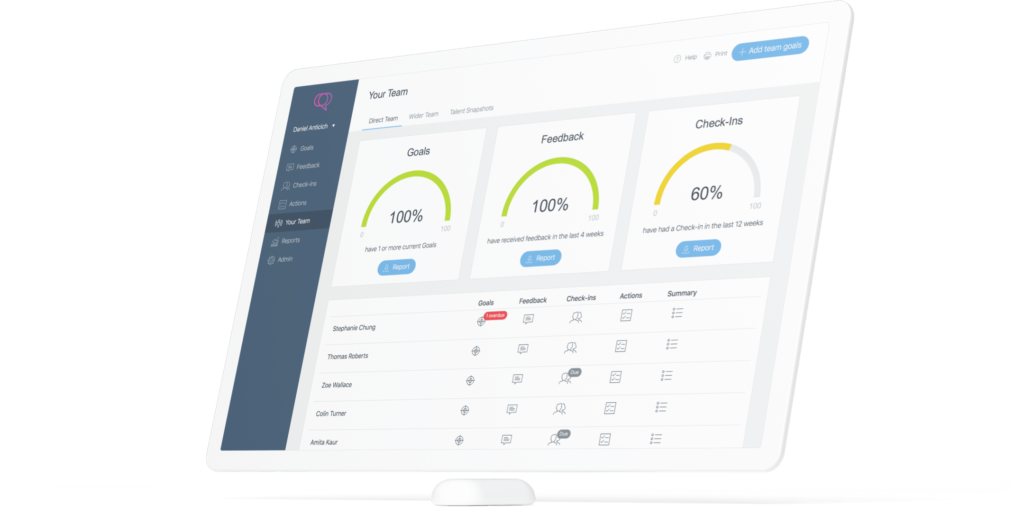

Successful exit of Clear Review delivering a 72% IRR

In October 2020, Mercia sold its stake in Clear Review for a cash consideration of £26.0million. The transaction followed a combination of Mercia’s managed funds in 2018 and then a direct investment in 2019. The acquirer, Advanced Business Software and Solutions, is the third largest British software and services company in the UK. Mercia held a 4.0% fully diluted direct holding in Clear Review at the date of sale and received cash proceeds of £1.0million representing a 2x return on its investment and a 72% IRR. In addition to this direct investment return, the sale will also generate an 8x..Read more

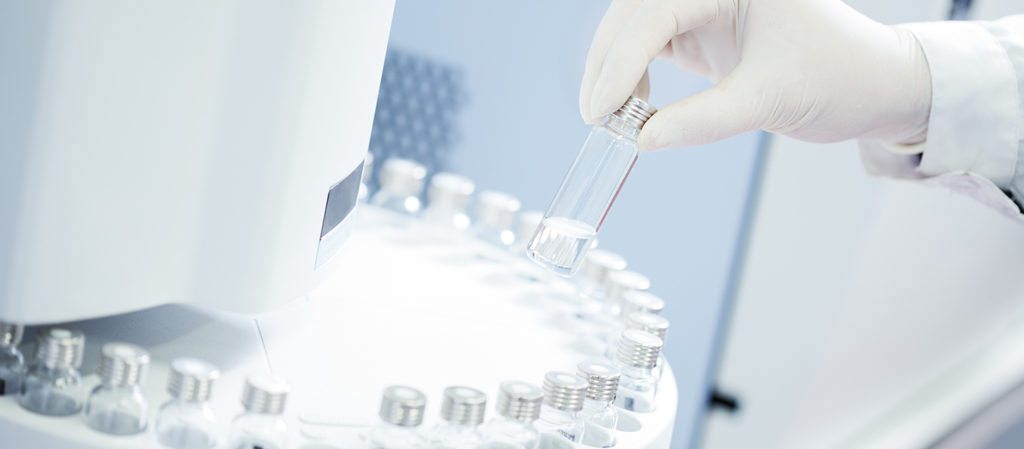

Mercia sells stake in The Native Antigen Company

Mercia sells stake in biotech EIS portfolio business spun out from the University of Birmingham Specialist asset manager, Mercia Asset Management PLC which has £800.0million of assets under management including more than £50.0million of EIS capital, has sold its stake in The Native Antigen Company , a leading producer of infectious disease reagents, to global life sciences tools company LGC . The sale of The Native Antigen Company is for a total cash consideration of up to £18.0million. The company, which was spun out of the University of Birmingham and backed by Mercia’s EIS funds since 2013, has generated..Read more

NVM Deal

Mercia completed the acquisition of the venture capital trust fund management business of NVM Private Equity LLP.

Jul 2019 New company name announced

As part of the 2019 Preliminary Results the Executive Team announce a change in name to Mercia Asset Management PLC now employing 85 investment professionals and support staff.

Mercia awarded North East Fund

Mercia Fund Managers is awarded the £27.0million Venture Fund to support businesses across the North East region as part of the £120.0million North East Fund.

Sale of Science Warehouse

Mercia’s second largest direct investment holding, Science Warehouse is sold to Advance Business Software and Solutions Limited for a full cash exit of £16.9million. The Group now employs 63 staff.

Mercia awarded Midlands Engine Investment Fund

Mercia Fund Managers is awarded a £23.0million Proof-of-Concept and Early Stage Equity Fund, part of the Midlands Engine Investment Fund.

First closing of EV Growth II

First closing of EV Growth II with initial commitments totalling £45.1million.

New partnership secured with the University of Edinburgh

Non-exclusive partnership is secured with the University of Edinburgh; providing access to Edinburgh Innovations and increasing Mercia’s university partnerships to 19.

New contracts awarded

Group wins significant new contracts totalling £108.5millon with British Business Bank, increasing third-party funds under management by nearly 50% to over £336.5million. The Group now employs 54 staff.

£40.0million placing completed

Placing of new Ordinary shares at a price of 46 pence per Ordinary share raising, in aggregate, £40.0million.

Sale of Allinea to ARM

Allinea Software is sold to ARM Limited for £18.1million.

AIM-listing for Concepta

Concepta PLC lists on AIM by way of a reverse takeover.

18 university partnerships

Mercia increases number of university partnerships to 18.

Acquisition of Enterprise Ventures

Mercia acquires Enterprise Ventures Group Limited, creating a go-to provider of early-stage and growth capital in the Midlands, the North of England, and Scotland, operating from six regional offices.

New offices and partnerships

Mercia opens an office in Edinburgh. It also begins Scottish partnerships with the University of Strathclyde and Abertay University, as well as three partnerships across the North of England with the Universities of York, Liverpool, and Liverpool John Moores University, taking its universities to 14 and now employing 20 staff.

Mercia Technologies lists on AIM

Mercia Technologies PLC listed on AIM, raising £70.0million. Mercia Fund Management becomes the wholly-owned subsidiary of Mercia Technologies, providing Mercia with a ‘Complete Capital Solution’ for technology businesses.The Group employs just 7 employees.

Nine university partnerships

Mercia Fund Management increases the number of university partnerships to nine across the Midlands, with £22.0million under management through third-party funds.

Relocation of offices

Mercia Fund Management relocates from Birmingham to Forward House in Henley-in-Arden (West Midlands).

First EIS/SEIS fund raised

Mercia Fund Management raises the first hybrid Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) fund to come onto the market.

Launch of Complete Capital Solution

Forward Group becomes a shareholder in Mercia Fund Management. It launches the full funding model of early-stage investment from third-party funds to follow-on direct investment from the balance sheet (the Complete Capital Solution).

Mercia Fund Management created

Management buyout leads to the creation of the third-party fund manager Mercia Fund Management with 3 employees and £12.0million of AuM

Collaboration with Forward Group

Forward Group establishes a collaboration with WME on the basis of their common interest in supporting and investing in the UK’s leading university spinouts.

Eight university partnerships

Mercia Fund Management expands university partnerships to eight.

Launch of MF1

WME launches Mercia Fund 1 (MF1), a £4.0million evergreen seed fund providing support and capital to spinouts from the Universities of Birmingham and Warwick.

WME established

WM Enterprise Limited (WME) is established in 1982 as a venture capital provider.