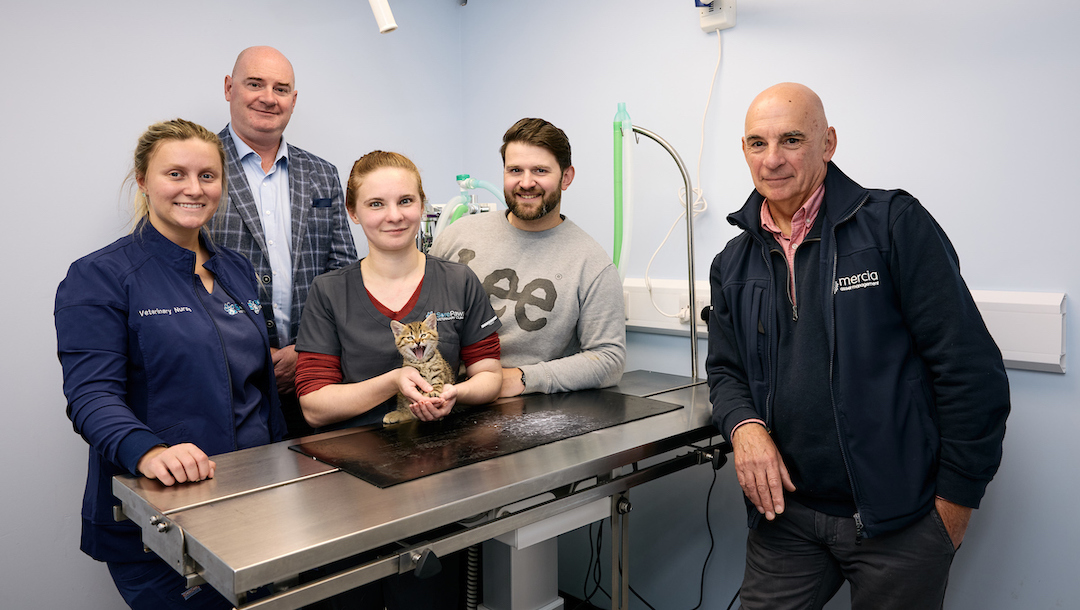

An independent Newton Aycliffe vets’ practice has raised £400,000 from NPIF II – Mercia Debt Finance, which is managed by Mercia Debt as part of the Northern Powerhouse Investment Fund II (NPIF II), to create a new purpose-built town centre clinic.

Sore Paws Veterinary Clinic has taken on 2,800 sq ft of space at Cobbers Hall Shopping Centre, which is three times the size of its existing surgery and currently being fitted out. The new facilities will include five consultation rooms, two operating theatres, a laboratory and X-Ray room, as well as separate areas for cats and dogs and a bereavement room with a separate entrance.

The practice will retain its existing premises – a 900 sq ft unit within the same shopping centre – but use it to house CT scanning facilities which will be available for hire by other vets in the area. It is also planning to take on additional staff, increasing the number of vets from four to seven and the number of nurses from six to nine.

The NPIF II funding will help to cover the cost of fitting out the new facility, buying additional equipment and provide additional working capital for growth.

Sore Paws was founded in 2015 by Dr Sarah Holmes. After qualifying as a vet, she worked in locations around the world – including a charity for street dogs and cats in India, and in wildlife conservation in Africa – before returning to the North East and taking over an ailing practice.

She was joined soon afterwards by her husband Aaron, who had previously spent 20 years in the Merchant Navy and who took on the role of Practice Manager. The couple now also run a second practice, Blue Star in Winlaton, which they acquired in 2018.

Sore Paws has treated around 6,000 pets over the past 12 months and has over 48,000 registered in total, with the number increasing by over 100 each month. Its revenue has almost doubled in the past three years.

Dr Holmes, Veterinary Director, says: “We are an independent practice that aims to combine modern medicine with old-fashioned care. With veterinary practice evolving fast, we believe it is important to keep up to date. The funding will enable us to stay at the forefront and offer a modern, purpose-built surgery with all the latest equipment while retaining the ‘village vet’ feel and our trusted relationship with clients.”

Gary Whitaker of Mercia Debt adds: “Sarah and Aaron have built a successful and growing practice but their existing unit was very cramped and they urgently needed more space. The NPIF II funding will enable them to fit out and equip their new premises and provide a more welcoming space for clients. Given the amount of new homes being built in the area, and the fact that one in three households now has a pet, it will also provide a valuable local facility for the people of Newton Aycliffe.”

Paul Grace of brokers YBFA provided fundraising advice to Sore Paws.

NPIF II – Mercia Debt Finance can provide loans in the NPIF II area with a primary focus on the Yorkshire and Humber regions of City of Kingston upon Hull and East Riding of Yorkshire, North Yorkshire, South Yorkshire and West Yorkshire.

The £660m Northern Powerhouse Investment Fund II (NPIF II) covers the entire North of England and provides loans from £25k to £2m and equity investment up to £5m to help a range of small and medium sized businesses to start up, scale up or stay ahead.

The purpose of the Northern Powerhouse Investment Fund II is to drive sustainable economic growth by supporting innovation and creating local opportunity for new and growing businesses across the North of England. The Northern Powerhouse Investment Fund II will increase the supply and diversity of early-stage finance for the North’s smaller businesses, providing funds to firms that might otherwise not receive investment and help to break down barriers in access to finance.